Building a strong credit score in India is like laying the foundation for your financial future. Whether you’re dreaming of a home loan, a new car, or just better credit card terms, a high credit score in India can open doors to lower interest rates and faster approvals. At HustleFinanceHub, we’re here to guide you through the 2025 updated steps to boost your credit score in India and make your money work harder. Let’s dive in and turn your credit game into a financial win!

What Is a Credit Score in India and Why Does It Matter?

A credit score in India is a three-digit number, typically between 300 and 900, that shows how reliable you are at repaying loans and managing debt. Credit bureaus like CIBIL, Experian, Equifax, and CRIF High Mark calculate it based on your financial habits. A strong credit score in India—ideally 750 or above—signals to lenders that you’re a low-risk borrower, unlocking better loan terms and financial opportunities.

Why care about your credit score in India? A high score can save you thousands on interest, get you premium credit cards, or even help you rent an apartment. Last year, my friend Priya got a home loan at 8% interest because her credit score in India was 780, while another friend with a 650 score paid 10%. That’s real money you can redirect to savings or investments!

How Is Your Credit Score in India Calculated?

Understanding what goes into your credit score in India is key to improving it. Credit bureaus use these factors:

- Payment History (35%): Paying EMIs and credit card bills on time boosts your credit score in India.

- Credit Utilization (30%): Using less than 30% of your credit limit shows discipline.

- Credit Mix (15%): A mix of secured (e.g., home loans) and unsecured (e.g., credit cards) credit helps.

- Length of Credit History (10%): Longer, well-managed accounts improve your score.

- New Credit (10%): Too many loan applications can lower your credit score in India.

In 2025, a credit score in India of 750–900 is considered excellent, 700–749 is good, 650–699 is fair, and below 650 is poor. Knowing these factors helped me focus on timely payments to lift my credit score in India by 50 points in six months.

Why a Strong Credit Score in India Matters in 2025

With digital lenders and RBI’s push for credit inclusion, your credit score in India is more important than ever. A score above 750 can mean:

- Lower Interest Rates: Save on loans for homes, cars, or education.

- Faster Approvals: Get loans or credit cards without delays.

- Better Financial Products: Access premium cards or higher loan amounts.

A low credit score in India, on the other hand, could lead to rejections or high interest rates, limiting your options. Building a strong credit score in India in 2025 is your ticket to financial flexibility.

10 Proven Tips to Boost Your Credit Score in India

Ready to improve your credit score in India? These 2025 updated tips, based on insights from experts like Experian and CRIF High Mark, will help you get there. Let’s break it down.

1. Pay EMIs and Bills on Time

Your payment history is the biggest factor affecting your credit score in India (35% impact). Set up auto-debits or reminders to pay credit card bills and loan EMIs before the due date. Late payments, even by a day, can ding your credit score in India significantly.

2. Keep Credit Utilization Below 30%

Credit utilization—how much of your credit limit you use—accounts for 30% of your credit score in India. For example, if your credit card limit is ₹1,00,000, keep your balance below ₹30,000. I started paying off my card weekly during the Flipkart Big Billion Days Sale to keep my utilization low, and my credit score in India jumped 20 points!

3. Maintain a Healthy Credit Mix

A mix of secured (e.g., car loans) and unsecured (e.g., credit cards) credit shows you can handle different debts. In 2025, diversify responsibly to boost your credit score in India. Don’t overdo it—too many loans can look risky.

4. Avoid Multiple Loan Applications

Each loan or credit card application triggers a “hard inquiry,” which can lower your credit score in India by a few points. Space out applications and only apply when necessary. Check pre-approved offers on apps like Bajaj Finserv to avoid inquiries.

5. Keep Old Credit Accounts Open

Closing old credit cards shortens your credit history, which hurts your credit score in India (10% impact). Keep older accounts active with small, timely payments. My oldest card, used sparingly, has helped keep my credit score in India strong.

6. Check Your Credit Report Regularly

Errors in your credit report can tank your credit score in India. You’re entitled to one free report per year from bureaus like CIBIL, Experian, or CRIF High Mark. Check every three months for mistakes, like a wrong payment status, and dispute them immediately.

7. Use Secured Credit Cards if Starting Out

If you’re new to credit, your credit score in India might be -1 (no history). A secured card, like the SBM ZET Credit Card backed by a ₹5,000 fixed deposit, is a great start. Use it responsibly to build your credit score in India fast.

8. Pay More Than the Minimum Due

Paying only the minimum on your credit card signals financial stress, hurting your credit score in India. Clear the full balance monthly to show discipline. This habit saved me from high interest and boosted my credit score in India over time.

9. Negotiate Settlements Carefully

Settling a loan for less than the full amount can hurt your credit score in India for up to seven years. If you must settle, negotiate with your lender to report it as “paid” rather than “settled.” This protects your credit score in India better.

10. Monitor Co-Signed or Joint Accounts

If you’re a co-signer on a loan, the primary borrower’s missed payments can lower your credit score in India. Monitor these accounts monthly and ensure timely payments. I learned this the hard way when a friend’s late EMI hit my credit score in India.

Common Myths About Your Credit Score in India

Let’s bust some myths that could confuse your efforts to build a strong credit score in India in 2025:

- Myth: Checking your credit score in India lowers it.

Truth: Self-checks are “soft inquiries” and don’t affect your score. Check freely via CIBIL or Experian. - Myth: You need to carry a credit card balance to build your credit score in India.

Truth: Paying your balance in full each month is best for your credit score in India. - Myth: Closing old cards boosts your credit score in India.

Truth: Keeping them open lengthens your credit history, helping your score. - Myth: Your income affects your credit score in India.

Truth: Only your debt management matters, not your salary.

My Journey to a Strong Credit Score in India

Two years ago, my credit score in India was a mediocre 620, and I struggled to get a car loan. I started by setting up auto-debits for my credit card and keeping my utilization below 30%. Within six months, my credit score in India hit 720, and I snagged a loan at 9% interest, saving ₹10,000 yearly compared to higher rates. Checking my CIBIL report quarterly and disputing a small error pushed my score to 760 by 2025. Consistency is key to building your credit score in India!

How a Strong Credit Score in India Fits Your Financial Plan

At HustleFinanceHub, we believe a strong credit score in India is a financial superpower. It ties to our tips on saving during sales like the Flipkart Big Billion Days—lower rates mean more savings to invest. A high credit score in India also aligns with our advice on budgeting for big purchases, like a home or car. It’s your ticket to financial freedom in 2025.

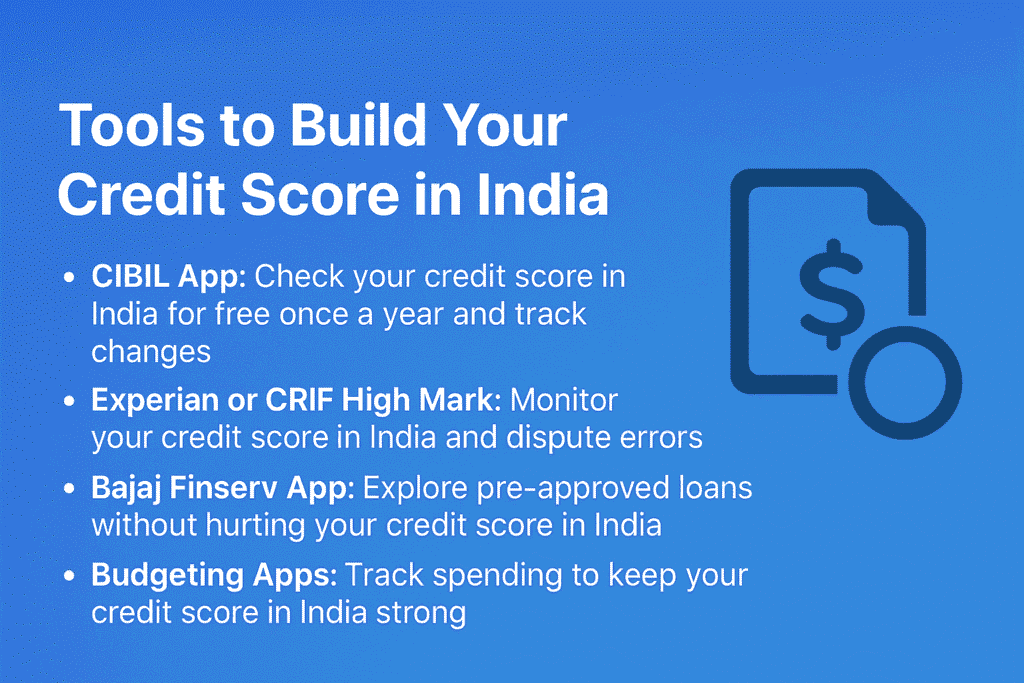

Tools to Build Your Credit Score in India

These tools can help you manage and improve your credit score in India:

- CIBIL App: Check your credit score in India for free once a year and track changes.

- Experian or CRIF High Mark: Monitor your credit score in India and dispute errors.

- Bajaj Finserv App: Explore pre-approved loans without hurting your credit score in India.

- Budgeting Apps: Track spending to keep your credit score in India strong.

New Trends Impacting Your Credit Score in India in 2025

The financial landscape is evolving, and these 2025 trends affect your credit score in India:

- Digital Lenders: More platforms like Niro Money use your credit score in India for instant loans, making a high score critical.

- UPI-Linked EMIs: Late UPI loan payments can hurt your credit score in India, so stay disciplined.

- RBI Credit Inclusion: New scoring models may include alternative data (e.g., utility payments) to help new borrowers build a credit score in India.

Planning Your Credit Score Strategy in 2025

To boost your credit score in India this year, start with these steps:

- Check Your Score: Get your free annual report from CIBIL or Experian to know your baseline credit score in India.

- Set Reminders: Use calendar alerts for EMI and bill payments to protect your credit score in India.

- Lower Utilization: Pay down credit card balances to keep usage below 30%.

- Dispute Errors: Contact your credit bureau if you spot mistakes in your report.

Why Your Credit Score in India Is a Financial Asset

A strong credit score in India isn’t just a number—it’s a tool for financial success. Saving on interest with a high credit score in India means more money for an emergency fund, mutual funds, or debt repayment. For example, a 50-point increase in your credit score in India could save ₹20,000 on a ₹5 lakh loan’s interest, boosting your financial goals.