Understanding What is expense ratio in mutual fund with example is essential for Indian investors navigating mutual funds. The expense ratio in mutual funds is the annual fee, shown as a percentage, that covers the cost of managing your investment. At HustleFinanceHub, we’re here to simplify this concept for you, using INR to make it relatable. Whether you’re starting your investment journey or refining your strategy, knowing the expense ratio helps you see what you’re paying. Let’s explore What is expense ratio in mutual fund with example and see how it affects your savings in India!

What Is an Expense Ratio in Mutual Funds?

The expense ratio in mutual funds is the yearly fee charged to manage a fund, expressed as a percentage of its assets. It covers costs like fund management, administration, and marketing. For instance, if you invest ₹1 lakh in a fund with a 1% expense ratio, you pay ₹1,000 annually. In India, SEBI caps expense ratios at 2.25% for equity funds and 2% for debt funds, ensuring fairness. Learning What is expense ratio in mutual fund with example helps you understand these costs. This fee is deducted daily from the fund’s net asset value (NAV), impacting your returns over time.

Why Expense Ratios Matter to Indian Investors

Expense ratios reduce your mutual fund returns, especially over long periods. A fund with a 2% expense ratio cuts more from your profits than one with a 0.5% ratio, affecting your wealth-building goals. In 2025, as mutual funds gain popularity in India, understanding these costs is crucial. For example, funds like SBI Bluechip (around 1.5% expense ratio) cost more than index funds like UTI Nifty 50 (0.2–0.5%). The What is expense ratio in mutual fund with example shows how fees impact your savings. Comparing ratios helps you keep more of your returns.

Components of an Expense Ratio

The expense ratio in mutual funds includes several costs. Management fees, typically 0.5–1%, pay fund managers for selecting stocks or bonds. Administrative expenses cover record-keeping and customer service, while marketing costs, like distributor commissions, are common in regular plans. SEBI mandates transparency, so you can find these details on AMFI or Moneycontrol for funds like HDFC Small Cap. Understanding these components, part of What is expense ratio in mutual fund with example, clarifies what you’re paying for. This knowledge helps Indian investors make informed choices.

How Is the Expense Ratio Calculated?

The expense ratio is calculated by dividing a fund’s total annual expenses by its average assets under management (AUM). For example, if a fund has ₹1,000 crore in AUM and ₹10 crore in expenses, the expense ratio is ₹10 crore ÷ ₹1,000 crore = 1%. This fee is deducted daily from the fund’s NAV, so it’s not a separate charge. SEBI ensures funds like Parag Parikh Flexi Cap report ratios clearly. You can check these on Value Research or Moneycontrol. The What is expense ratio in mutual fund with example makes this calculation easy to understand.

Example of Expense Ratio in a Mutual Fund

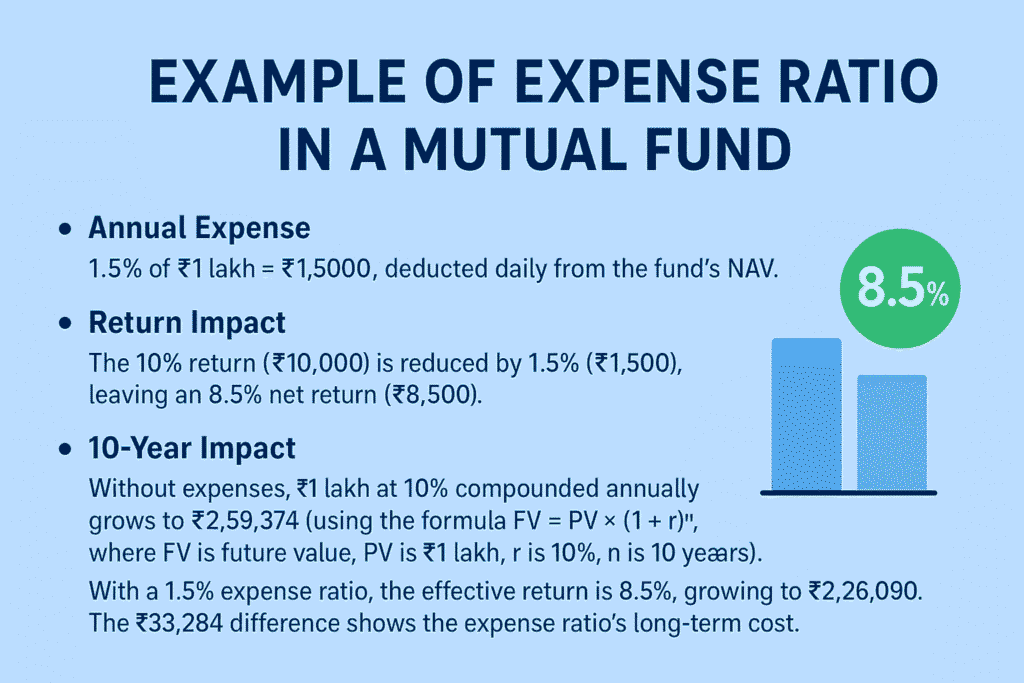

To grasp What is expense ratio in mutual fund with example, consider a fictional ABC Equity Fund. You invest ₹1 lakh, and the fund has a 1.5% expense ratio with a 10% annual return before expenses. Here’s how it works:

- Annual Expense: 1.5% of ₹1 lakh = ₹1,500, deducted daily from the fund’s NAV.

- Return Impact: The 10% return (₹10,000) is reduced by 1.5% (₹1,500), leaving an 8.5% net return (₹8,500).

- 10-Year Impact: Without expenses, ₹1 lakh at 10% compounded annually grows to ₹2,59,374 (using the formula FV = PV × (1 + r)^n, where FV is future value, PV is ₹1 lakh, r is 10%, n is 10 years). With a 1.5% expense ratio, the effective return is 8.5%, growing to ₹2,26,090. The ₹33,284 difference shows the expense ratio’s long-term cost.

| Scenario | Initial Investment | Annual Return | Expense Ratio | 10-Year Value | Cost of Expenses |

|---|---|---|---|---|---|

| Without Expense Ratio | ₹1,00,000 | 10% | 0% | ₹2,59,374 | ₹0 |

| With Expense Ratio | ₹1,00,000 | 10% | 1.5% | ₹2,26,090 | ₹33,284 |

This example of What is expense ratio in mutual fund with example shows why checking fees matters for Indian investors.

Active vs. Passive Funds: Expense Ratio Differences

Active funds, like Axis Midcap, have higher expense ratios (1–2%) due to active stock selection requiring research. Passive funds, like Nippon India ETF Nifty 50, track indices with lower ratios (0.2–0.5%) as they need less management. In India, active funds are common, but passive funds are growing in 2025 for their low costs. Comparing ratios on AMFI helps you see the difference. This ties to What is expense ratio in mutual fund with example, showing why passive funds can save money. Check funds like ICICI Prudential Bluechip (active) versus UTI Nifty 50 (passive).

How Expense Ratios Impact Long-Term Returns

Even a 1% difference in expense ratios can significantly reduce your wealth. For a ₹1 lakh investment, a 2% ratio versus a 0.5% ratio could mean a ₹50,000–₹1 lakh gap after 20 years at 10% returns. This compounding effect makes low-cost funds critical for Indian investors. In 2025, platforms like Moneycontrol list ratios for funds like Mirae Asset Large Cap (1–1.5%). Understanding What is expense ratio in mutual fund with example helps you plan for better returns. Small savings on fees add up over time.

SEBI Regulations on Expense Ratios in India

SEBI protects Indian investors by capping expense ratios. Equity funds are limited to 2.25% for the first ₹500 crore of AUM, decreasing as AUM grows. Debt funds have a 2% cap. Direct plans, without distributor fees, have lower ratios (e.g., 0.8% vs. 1.8% for regular plans). Funds like Kotak Flexicap must disclose ratios on AMFI, per SEBI rules. Knowing these regulations, part of What is expense ratio in mutual fund with example, helps you choose cost-effective funds.

How to Check a Fund’s Expense Ratio

Checking a mutual fund’s expense ratio is simple with online tools. Visit AMFI or Moneycontrol to find ratios for funds like Nippon India Small Cap. Fund factsheets on fund house websites also list these costs. Apps like Groww or Zerodha Coin offer quick comparisons. In 2025, SEBI’s transparency push makes this data accessible. Checking ratios regularly aligns with What is expense ratio in mutual fund with example, helping you stay informed about costs.

Tips to Manage Expense Ratio Costs

You can’t avoid expense ratios, but you can reduce their impact. Use Value Research to find low-cost funds like index funds (0.2–0.5% ratios). Opt for direct plans to save on commissions (0.5–1% lower). Monitor ratios yearly, as they vary with AUM changes. Avoid funds with high ratios (above 2%) unless they consistently outperform. These tips, tied to What is expense ratio in mutual fund with example, help Indian investors maximize returns.

Why Expense Ratios Are Key in India in 2025

In 2025, mutual funds are a top choice for Indian savers, making expense ratios more important. Higher AUM can lower ratios due to SEBI’s sliding scale, but active funds with marketing costs (0.5% of the ratio) remain pricier. New funds launching in 2025 may have higher ratios to cover startup costs. Platforms like Moneycontrol help you track these trends. Understanding What is expense ratio in mutual fund with example keeps you ahead in financial planning. Low-cost funds mean more money in your pocket.

Pingback: Top 5 Low-Risk Investments with High Returns in 2025 - hustlefinancehub.com